AI and Machine Learning

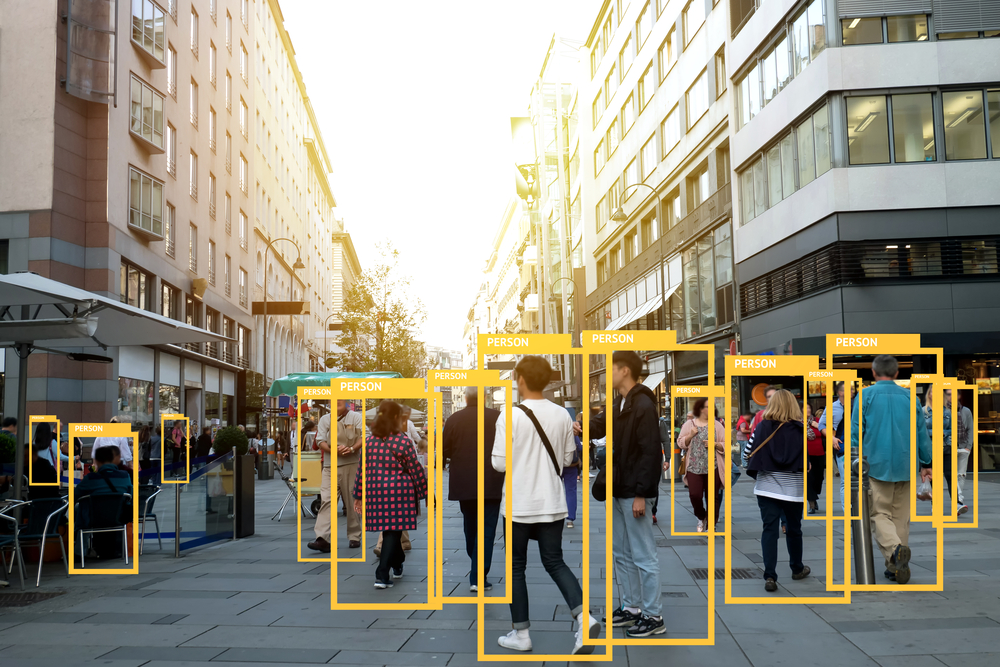

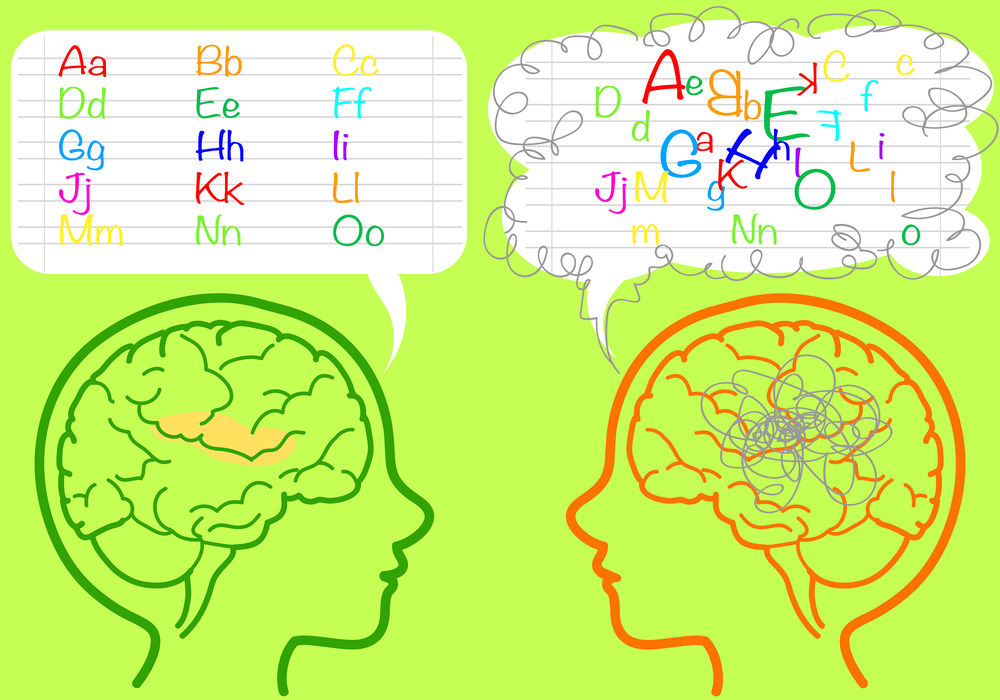

This blog category is devoted to artificial intelligence, a rapidly growing field of computer science that deals with the creation of intelligent agents, which are systems that can reason, learn, and act autonomously, also check out our Artificial Intelligence courses.